Acacia Research (ACTG $40.50) remains on track to produce excellent on-target Q4 results. Acacia is the leading provider of intellectual property monetization services. The company collaborates with patent holders to settle IP disputes against infringing businesses. Acacia and its partners divide settlement proceeds.

Acacia acquired 230 new patents (in 13 countries) from its recent purchase of Adaptix Technology, a 4G LTE (“Long Term Evolution”, a high-speed wireless communications standard) technology developer, for $160 million. There are 15 “families” of patents within the portfolio, which cover many aspects of 4G and LTE technology. The company owns 100% of this patent portfolio, meaning it keeps all settlement winnings, minus costs for independent legal counsel. These outside firms typically retain 15%-20% of winnings when they are called in. Early licensing deals for the Adaptix patents have been completed with Microsoft and Samsung without litigation. Both companies entered into “structured settlements” with Acacia in 2010 and 2011, respectively, granting them use of Acacia’s entire portfolio for three years. Acacia has a similar agreement with Oracle, signed in 2010. The company has also asserted the Adaptix patents against AT&T, Motorola, and Nokia Siemens. The lawsuits were filed prior to the Adaptix acquisition to give Acacia a window into the portfolio’s portential.

Several Acacia subsidiaries also recently reached licensing agreements. Smooth Impact LLC avoided litigation by settling with Olympic Tools International, Inc., over impact instrument technology patents. Chalumeau Power Systems LLC resolved a dispute with SMC Networks, regarding Power over Ethernet (“PoE”) patents. Acacia’s medical technology portfolio continues to grow as well, with its recent acquisition of a group of patents involving catheter ablation technology. These licensing agreements will net higher revenues since they were settled outside of court.

The Adaptix acquisition gave Acacia’s stock price a little boost, but investors are still waiting for new structured settlements to increase earnings. Acacia’s fervent acquisition of patents in 2011 has raised the price on future structured settlements, which companies like Apple and Google have been unwilling to pay so far. These settlements immediately augment earnings. Acacia figures it will make even more over time, but from an investor’s point of view that involves risk and the time value of money. Income from standalone deals continues to advance, so results for Q4 should compare favorably to 2010.Our fourth quarter estimates remain unaltered.

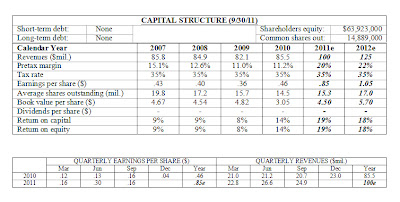

( Click on Table to Enlarge )