Distribution to the engineering market has stalled because of the lack of follow through by Hewlett Packard. In the June quarter Stratasys finally through its hands up and began laying plans to resume its own distribution efforts in that segment. That program might take a year or longer to bear meaningful fruit. In the interim business with high end manufacturing customers is gaining momentum. Those products cost 20x as much as the engineering models, so a handful of incremental sales could make a big difference on financial performance. Stratasys also sells consumables (different types of plastic) that are used by the machines. Demand for those materials have remained vibrant so far in Q3.

Stratasys hasn't commented on how the latest changes in strategy are affecting its results. Our estimates involve an unusually high amount of guesswork as a result. It looks like the macroeconomic downturn hasn't impacted business to date, though. Sales of high end systems and consumables look like they're doing well, perhaps accelerating. And while the H-P contribution remains negligible Stratasys still operates a sizable sales network of its own aimed at the prototype segment. It would have been larger by now if the company hadn't wasted time with Hewlett Packard. But it's still meaningful.

The stock entails considerable uncertainty. The price has fallen dramatically, though, from where it was after the H-P relationship originally was established. Venturesome investors realistically can tiptoe into the stock at current levels. The long term outlook remains terrific. Stratasys continues to be the industry leader. Finances are solid. Near term earnings might not be fantastic but a major catastrophe appears unlikely.

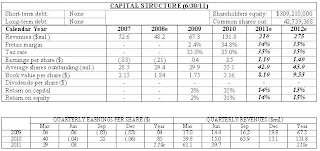

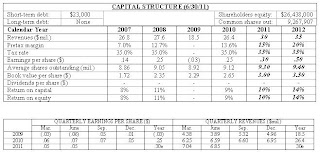

( Click on Table to Enlarge )