A new product offers huge potential. Kombucha is a fermented tea based drink that originally was developed 100 years ago in Russia and Germany. Despite evidence that suggested it provided a range of health benefits kombucha didn't gain popularity until the 1990s. A privately owned company, GT Dave, created the U.S. market with a social media marketing program that emphasized those health benefits. The primary topic was cancer prevention. Other claims included liver detoxification, arthritis prevention, high levels of antioxidants, and probiotic benefits. Ronald Reagan used kombucha to fight his cancer starting in 1987 and lived until 2004. He got the tip from Alexander Solzhenitsyn, who used it to battle his stomach cancer.

Kombucha has grown into a $300 million (retail) industry in the United States. GT Dave still controls 80%-90% of the market, perhaps more. Other drinks manufacturers have tried to enter the lucrative business but have had difficulty making the product correctly. Reed's appears to have solved the riddle, at least in small quantities. In June 2012 the company announced the introduction of four flavors. The official launch started in November. Production currently is limited by capacity constraints. Larger vats are slated for operation during the first half of 2013. Reed's additionally plans to add four more flavors during the first quarter. Distribution is ramping up at a brisk pace, although initial deliveries are relatively small and most of that will be sold at promotional pricing. The retail channel is anxious for Reed's to be successful in lifting output and providing an alternative to DL Dave's offering. The theory is that with two strong contenders the kombucha category will expand and become a mainstream product.

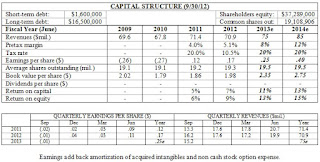

Our estimates assume Reed's is successful at expanding kombucha production. We also think the company's traditional drinks and private label brands will continue growing at their current rate. Start-up costs are likely to exert a drag on income, though. And while the manufacturing expansion will raise volume we estimate the kombucha line will grow in fits and starts as the technology is fine tuned. We estimate 2013 income (fully taxed) will advance to $.10 a share on sales of $40 million.

Once the scaling up is complete results could skyrocket. In 2-3 years sales could reach $75-$100 million to produce earnings of $.55-$.75 a share. Cash flow will be stronger than that due to the availability of extensive tax loss carryforwards. Reed's carries a fairly high debt load, so downside risk could be high in the event the kombucha line fails to develop. Losses could be substantial if problems arise, potentially requiring dilutive financing. If things pan out worthwhile appreciation could be realized. Applying a P/E multiple of 20x to the midpoint of our projected earnings range suggests a target price of $15 a share (+165%). Reed's could obtain an even higher valuation as an acquisition candidate. A large buyer theoretically could enhance margins and expand distribution.

These shares entail a higher than normal degree of risk Limits are advised. Conservative investors are advised to wait either for a lower stock price or more evidence that the kombucha launch will prove successful.

( Click on Table to Enlarge )