Acacia Research (ACTG $33.00) appears on track to produce excellent on target Q3 results. The company recently turned down two prospective "structured" deals that would have generated significant one time payments. In light of the recent surge in patent activity throughout Corporate America, the company thought those transactions might be undervalued. New patent portfolios continue to be added. Two major ones are in negotiations. Acacia has identified several companies that own patents worth far more than their market capitalizations. Thought is being given to purchasing those targets for the intellectual property, and then spinning off the base businesses. A variety of other strategies are being evaluated.

Demand for the company's services is poised to expand in upcoming periods. Earnings and access to capital are declining, prompting potential partners to license patents via Acacia to generate cash. Direct competition has not developed to date. These shares continue to hold tremendous potential. Operating income could climb at above average rates well into the decade. A series of one time hits could amplify performance, perhaps dramatically. Our estimates assume Acacia will sign one structured transaction in each of the next six quarters at revenue amounts consistent with previous deals.

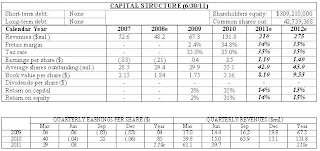

( Click on Table to Enlarge )

No comments:

Post a Comment