Napco Security Technologies (NSSC $3.35) appears on track to produce solid Q2 (December) results. The company is a leading provider of security systems for commercial (80%) and residential (20%) customers. Based in the northeast, performance was impacted recently by Hurricane Sandy. Product updates and greater marketing efforts have bolstered Napco's core performance. Improving real estate activity is adding further impetus. The introduction of a next generation Internet based technology promises to amplify results over the next several years. Those products enable customers to control their systems remotely and perform a wider range of features. The new line includes a recurring revenue component which promises to bolster margins. The critical software included in the systems will need to be upgraded over time. The recurring revenue ensures the technology improvements are delivered. Adoption of the new wireless and Internet products is growing rapidly, albeit from a small base. Broader acceptance is possible if the cable companies begin to market security products more aggressively. Most have added them to their product lines but so far the selling effort has been muted.

Margins could expand materially down the line. The recurring revenue should improve them directly. Napco also is operating below capacity at present. So higher sales will spread fixed costs over a broader base. The tax rate is likely to remain at 20% due to offshore manufacturing. In 2-3 years sales could achieve $100 million to produce income of $.75 a share.

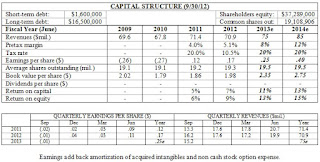

( Click on Table to Enlarge )

This seems interesting, but along with every transaction must be considered properly

ReplyDelete